Hourly wage with overtime calculator

Then the employee enters the number of hours worked into the Hours box. Quarterly Salary Annual Salary 4.

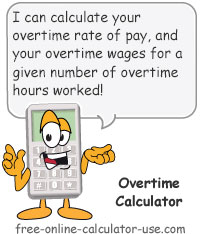

Overtime Calculator To Calculate Time And A Half Rate And More

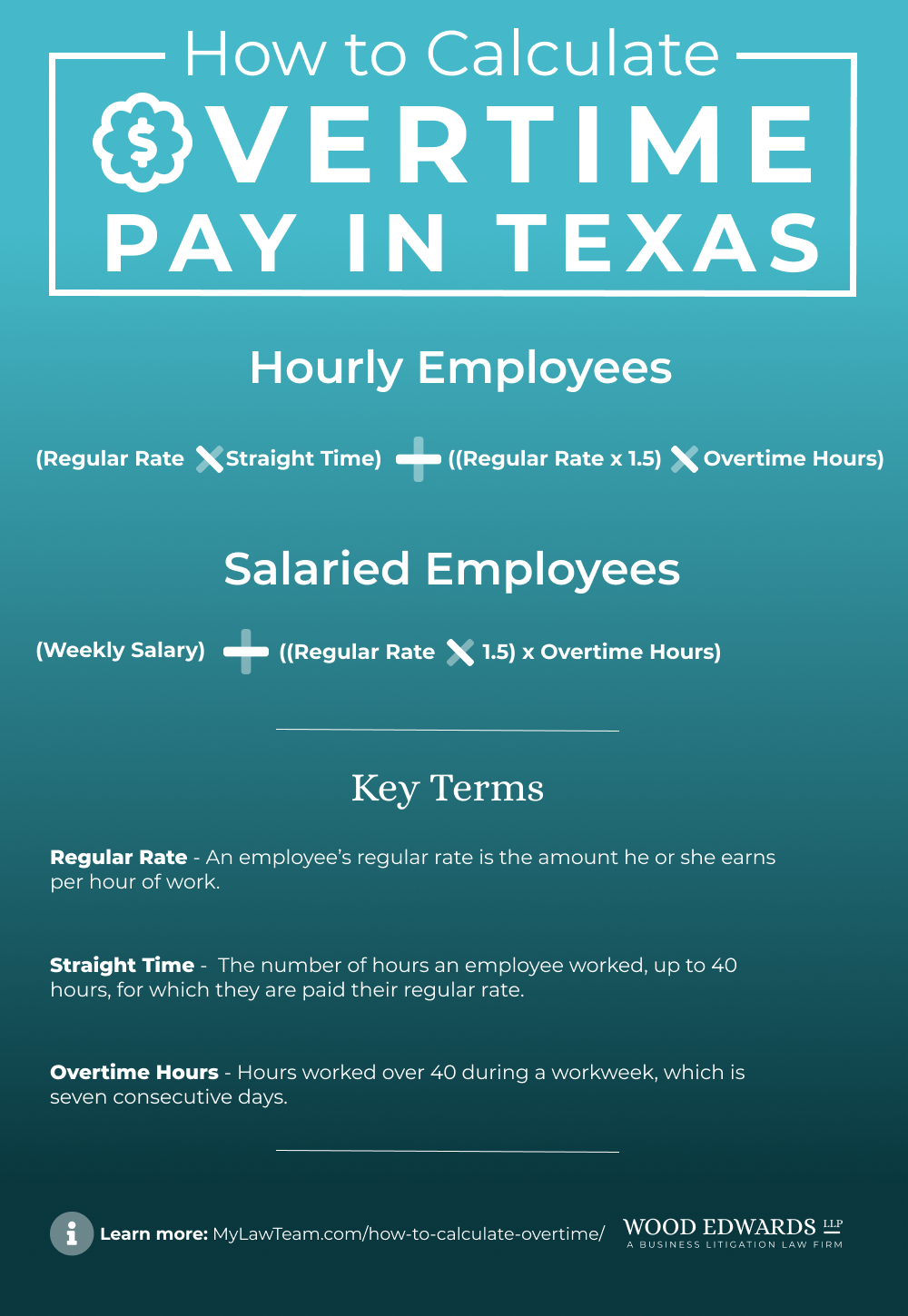

Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage.

. This calculator assumes a work week consists of 40 hours and a work day consists of 8 hours. Therefore Virginias overtime minimum wage is 1650 per hour one and a half times the regular Virginia minimum wage of 1100 per hour. Use this calculator to convert your hourly wage to an equivalent annual income as well as weekly and monthly wage.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. What is the hourly minimum wage in Ontario. Therefore Missouris overtime minimum wage is 1673 per hour one and a half times the regular Missouri minimum wage of 1115 per hour.

Enter Number of Hours. The calculator has a drop-down menu that provides an option to enter either the hours worked per week or per month. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay.

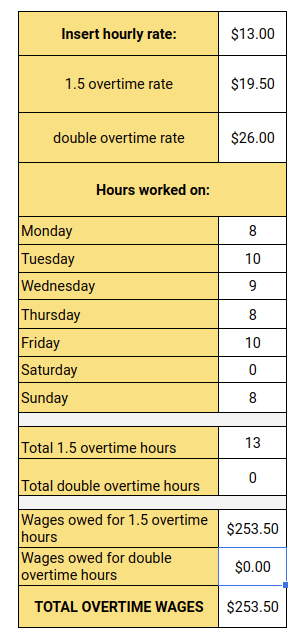

There is in depth information on how to estimate salary earnings per each period below the. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. 1000154 1500 4 6000.

The California minimum wage was last. B Daily wage WL HPD C Weekly wage WL HPD HPW. Visit to see yearly monthly weekly and daily pay tables and graphs.

It can also give you an annual wage taking your overtime into account. Texas Overtime Minimum Wage. Therefore overtime pay is not included in these calculations.

Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek. All you need to do is. Hourly to salary wage calculator is a tool that helps you determine your wage or salary depending on the period you know.

First enter the dollar amount of the wage you wish to convert as well as the period of time that the wage represents. Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days. Annual Salary Hourly Wage Hours per workweek 52 weeks.

Florida Overtime Wage Calculator. The overtime hours are calculated as 15 standard hourly rate but can vary. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each.

Easily convert hourly wage or pay rate to salary. Californias state minimum wage rate is 1400 per hourThis is greater than the Federal Minimum Wage of 725. In addition firefighters covered by 5 USC.

1000 8 8000 Overtime. These figures are pre-tax and based on working 40 hours per week for 52 weeks of the year with no overtime. In Florida overtime hours are any hours over 40 worked in a single week.

18hour 15 27hour. While in case of the second tab called Hourly wage the equations used are-IF the hourly option is checked THEN. 5545b are subject to special rules for computing hourly rates and overtime pay.

For instance in case the hourly rate is 1000 and someone works 4 extra hours over the standard time of 8 hours a day his daily wage will be. If you earn more then the Missouri minimum wage rate you are. An employer is required to pay their employees one and one-half times their regular rate of pay for all hours over 8 hours in a workday and over 40 hours in a workweek.

Semi-Monthly Salary Annual Salary 24. Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. You are entitled to be paid the higher state minimum wage.

If you earn more then the Arizona minimum wage rate you are. Enter the length of the standard work week in hours In. Enter the number of hours you work a week and click on Convert Wage.

Input your regular hourly pay rate. The formula of calculating annual salary and hourly wage is as follow. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. Therefore Arizonas overtime minimum wage is 1920 per hour one and a half times the regular Arizona minimum wage of 1280 per hour. Virginias Overtime Minimum Wage.

Exceptions apply for some jobs including managers doctors lawyers dentists engineers and architects. In the case of our example the overtime rate is equal. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

If you earn more then the Virginia minimum wage rate you are. Enter the Number. So to have clarity lets recalculate the monthly payment to include overtime hours.

Our overtime calculator is the perfect tool to help you see how much money you will earn in exchange for those extra hours at work. The salary calculator will also give you information on your weekly income and monthly totals. The hourly minimum wage in Ontario is 1500.

It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck recalculate monthly wage to hourly rate weekly rate to a yearly wage etc. This law includes nonexempt employees who are paid hourly salary and those who are paid on piece rate. Any hours beyond the standard 40 are considered overtime.

The regular rate on which overtime pay is calculated includes remuneration or pay for employment and certain payments made in the form of goods or facilities customarily. Enter the Hourly Wage Amount. Hourly weekly biweekly semi-monthly monthly quarterly and annually.

The next step is to enter this amount into the online calculators Hourly Wage box. California Overtime Wage Calculator. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Calculating an Hourly salary from an Annual revenue. You can factor in paid vacation time and holidays to figure out the total number of working days in a year. The minimum wage applies to most employees in California with limited exceptions including tipped employees some student workers and other exempt occupations.

Lets say for a month our employee worked for 100. Arizonas Overtime Minimum Wage. See 5 CFR part 550 subpart M.

If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if. Therefore Texas overtime minimum wage is 1088 per hour one and a half times the regular Texas minimum wage of 725 per hour. Missouris Overtime Minimum Wage.

They must be compensated at least 15 times the employees regular hourly rate. If you earn more then the Texas minimum wage rate you are entitled to at. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions.

-Total gross pay Regular gross pay Overtime gross pay Double time gross pay. Hourly Weekly Monthly Yearly. Covered nonexempt employees must be paid overtime pay at no less than one and one-half times the employees regular rate of pay for hours worked in excess of 40 in a workweek.

A Hourly wage is the value the user inputs within the 1 st field WL. Use our salary conversion calculator. Also rates of pay for certain Department of Veterans Affairs employees paid under title 38 United States Code are computed using a 2080 hourly divisor.

This calculator can convert a stated wage into the following common periodic terms. Overtime pay also called time and a half pay is one and a half times an employees normal hourly wage. Monthly Salary Annual Salary 12.

It is so easy to use. Salary to hourly wage calculator lets you see how much you earn over different periods.

Overtime Pay Calculators

Overtime Pay Calculators

Logwork Free Timesheet Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

Overtime Calculator Gpetrium

Hourly Wages Worksheet

Overtime Pay Calculators

How To Calculate Overtime Pay In Texas Updated For 2022

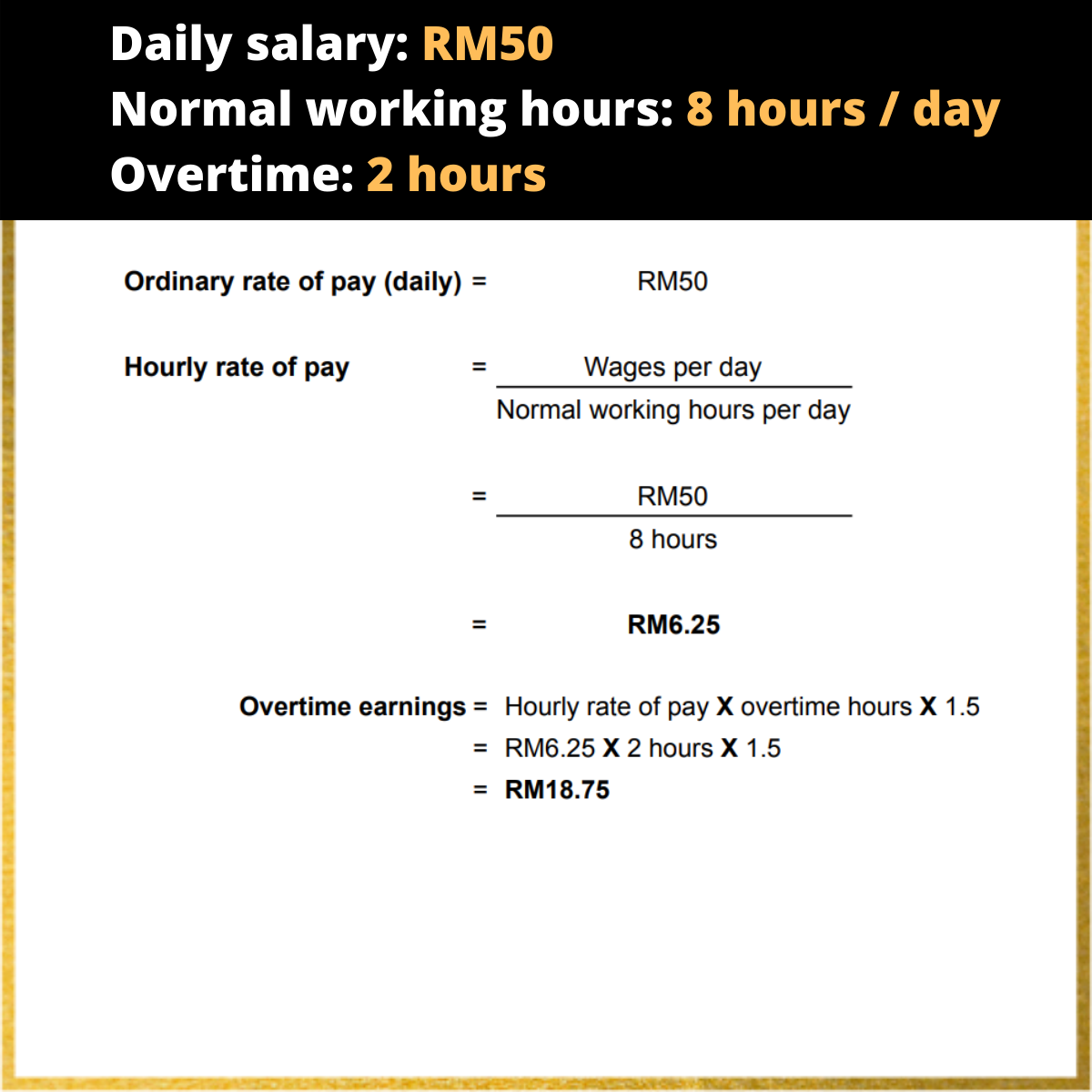

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Pay Calculators

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Earnings From Hourly Pay Rate Formula For Calculating Overtime Pay Youtube

Overtime Calculator

Overtime Calculator Workest

How To Quickly Calculate The Overtime And Payment In Excel

How To Calculate Overtime Pay From For Salary Employees Youtube